Jan.

17

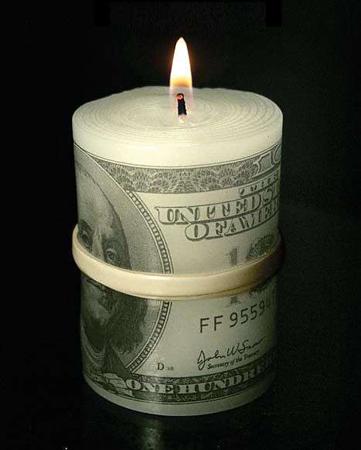

Take Control of Your Money

Growing up my Dad emphasized to us the importance of taking charge of our money and once out on my own, I followed Dad’s advice to the letter and it worked. That’s not to say that at times I didn’t have to forgo things I really wanted, but carrying very little debt felt alot better than dodging creditors, so I toughed it out and it made all the difference in the world. As I became more successful, finance expert BETH KOBLINER and her book Get A Financial Life helped me become financially healthy once and for all, here’s some of what I learned:

Health insurance should be a financial priority.

The right health insurance, that you purchase yourself or through your employer, will protect you if you have a serious accident or illness and guarantees that you don’t bankrupt yourself or your family if you are beset with major medical problems. If you have to purchase health insurance on your own, be sure to price compare at www.netquote.com or www.bluecares.com.

Be smart about paying off your debt.

One of the smartest moves you can make is to take any savings you have (excluding the money needed for essentials like food, rent, and health insurance) and pay off any high-rate loans. You can “earn” more by paying off a loan that is accruing interest than you can by saving and investing while holding debt. If you can’t pay off your high-rate debt immediately, try to reduce your interest rate by calling your credit provider and asking them to lower your rate.

If you have several different types of debt — credit cards, car loans, student loans, etc — pay off the loan with the highest interest rate first. Then tackle the next highest loan until you have reduced your overall debt completely.

Other debt-reducing tips:

- Pay your bills on time

- Limit your ATM withdrawals to one per week

- Don’t use your credit cards for cash advances

- Say “No, thank you” to department store credit cards

- Check auto loan rates and car pricing before you go to a dealership and don’t reveal how much you can afford to pay monthly because once the dealer knows that he can adjust his terms to match your monthly figure. Always negotiate an exact price before you discuss any financing. Try to make a down payment of at least 20%.

- Before you go house hunting, get “pre qualified” so that you have an idea of how big a mortgage you can actually afford.

Take advantage of retirement savings plans at work.

Contributing to a tax-favored retirement plan is one of the smartest things you can do. If your company offers a 401(k), you should take advantage of it especially since many companies will match a portion of the amount you put into the account based on a percentage of your salary. That’s free money! And the government won’t tax your retirement plan until you withdraw the money, so that amounts to additional savings of hundreds of dollars each year.

Save for a rainy day.

Saving money is hard, especially in a tough economic climate, but it’s necessary for your financial health. So, once you’ve gotten rid of your high-rate debt and purchased health insurance, you should start stashing away money to reach at least three months’ worth of living expenses in a savings account. Automatic withdrawals from your paycheck once per month makes saving easier.

Know your credit score and work to improve it.

Your credit score reflects your financial behavior and employers and lenders will use it to determine if you are a good risk. Every year request one FREE copy of your credit reports from each of the major credit reporting agencies by requesting them at www.annualcreditreport.com. Make sure all the information the agencies: Equifax, TransUnion and Experian have on file is correct. Pay for your credit score every few years so you can take steps to improve it, if necessary.

Get smart about your income taxes.

Take advantage of all tax deductions that apply to you by determining if you should take a standard deduction which is a fixed dollar amount that you subtract from your income or if you should itemize deductions which is listing specific items that are deductible according to current tax rules.

For example, if you itemize, you may be able to take advantage of deductions for state and local income taxes, sales taxes, property taxes, donations to charity, housing costs and out-of-pocket medical and dental expenses if they are greater than 7.5% of your adjusted gross income. Be sure to check www.irs.gov to insure that these deductions are still valid. Itemized deductions are only advantageous if their total is bigger than your standard deduction, so do the math.

If you don’t earn alot right now, you may be tempted to fill out the 1040EZ, but doing so may mean that you miss out on money saving deductions, so consider more detailed forms like the 1040 and Schedule A to insure that you don’t pay unnecessary taxes. If you have children or educational expenses you may qualify for tax credits, so be thorough when preparing your taxes each year and get back the money due to you.

Always have a clear financial plan and set yearly goals.

To finally get out of debt and take control of your money, write down your financial goals. Do you want to own a home? Buy a new car? Put your kids through college? Whatever your heart’s desire, it is achievable if you are willing to set monthly and yearly goals and stick to them.

Some financial information from Get A Financial Life used with permission of Beth Kobliner.

Photo: Tara Donne

| • Art | • 1 Comment |

January 17, 2012 at 11:49 am

Excellent article. It has great points that will truly generate positive results in the end.